Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. Spreads, Straddles, and other multiple-leg option orders placed online will incur $0.65 fees per contract on each leg. Orders placed by other means will have additional transaction costs. All four strategies are great for trading candlestick reversal patterns like the harami.

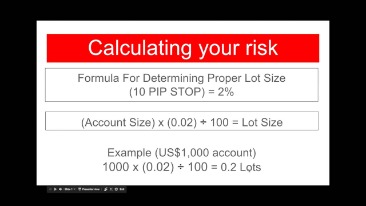

You should consider whether you can afford to take the high risk of losing your money. To define this condition we say that the 10-period ADX needs to be higher than 25, meaning that we have much volatility in the market. Sometimes we use a moving average and check whether the volume of the current bar is higher or lower than the average volume a couple of bars back. Other times we just compare the volume of today to the volume of the previous bar.

Trading Strategies:

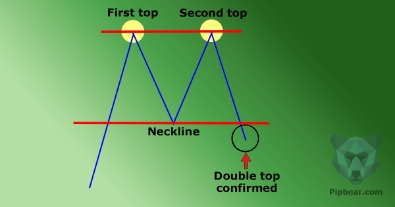

The price continued lower for a couple of weeks before reversing and then breaking above the resistance level. Having said this, we want to show you a couple of the filters and conditions that we have had a great experience with in our own strategies. Once the next candle opens, sellers start off by pushing the open below the close of the previous bar. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend. Here you can find our Candlestick pattern archive with many articles covering the subject.

Crude Oil Early September Rally Sets the Stage for Another Monthly Gain? – DailyFX

Crude Oil Early September Rally Sets the Stage for Another Monthly Gain?.

Posted: Sat, 09 Sep 2023 20:00:00 GMT [source]

As we can see, prices head lower almost immediately after the formation of the Harami candlestick pattern. This means traders could have established short positions in the asset, with stop-loss orders placed above the high of the first candlestick in the Harami pattern. Under this scenario, traders could have captured significant gains while experiencing little to no drawdown on short positions. Since these patterns occur in relatively high frequencies, traders can implement Harami trading strategies as part of a consistent repeatable strategy to capture profits. The following chart shows a bearish harami cross in American Airlines Group Inc. (AAL).

Sellers are dominating the market, and buyers wait for a signal that the bearish trend has come to an end. Second, you should then look closely at the movement of the candlesticks and identify when a large candlestick is followed by a small candle. For the pattern to happen, the smaller candle must be completely engulfed by a larger one. And here is another example where a bullish harami occurred, but the stoploss on the trade triggered a loss. The risk-averse will initiate the trade the day near the close of the day after P2, provided it is a blue candle day, which in this case is. The filled or hollow portion of the candle is known as the body or real body, and can be long, normal, or short depending on its proportion to the lines above or below it.

AskTraders Summary: The Harami Candlestick Pattern

Scroll through widgets of the different content available for the symbol. The “More Data” widgets are also available from the Links column of the right side of the data table. This page provides a list of stocks where a specific Candlestick pattern has been detected. Once the trade has been initiated, the trader will have to wait for either the target to be hit or the stop loss to be triggered.

- You need to add some sort of filter or additional condition to ensure that you have a real edge.

- You can spot the Harami patterns, determine whether they are bearish or bullish, and explore how well they predict the candles that follow.

- You can look at this article to see some of the most common reversal indicators you can use in the market.

- As such we may earn a commision when you make a purchase after following a link from our website.

- However, gapping on forex charts is rare due to the 24-hour nature of forex trading.

If the candles leading up to the bearish harami are long and big compared to the other bars, you know that the market is quite strong and determined to move higher. Sometimes a pattern that’s formed with high volatility is more reliable than one that’s formed in low volatility conditions. What works best depends on the market and timeframe you’re trading, and you should test and see what works the best for you. The risk-taker will initiate the trade on day 2, near the closing price of 125. The risk-averse will initiate the trade on the day after P2, only after ensuring it forms a red candle day. In the above example, the risk-averse would have avoided the trade completely.

Suddenly, Facebook’s price breaks the pennant to the downside and thus we continue to hold our short position. First, we start with the red circle at the beginning of the chart. Yet, we do not enter the market, because the next set of candles do not validate a reversal.

Watch the Ranges of the Candles

This signals that there is uncertainty in the continuation of the ongoing trend. The lines above and below, known as shadows, tails, or wicks, represent the high and low price ranges within a specified time period. Candlesticks are graphical representations of price movements for a given period of time. Then you will have confidence to take the trade knowing your ratio of wins to losses. Now that we are short Citigroup, we wait for an opposite signal from the stochastic. 5 periods later, the blue stochastic line hops into the oversold area for a moment.

In addition, with the next two red candles we confirm a Three Black Crows candle pattern, shown in the green circle. This is when we sell Facebook short and begin to follow the price action. The Harami candlestick pattern is usually considered more of a secondary candlestick pattern. These are not as powerful as the formations we went over in our Candlestick Patterns Explained article; nonetheless, they are important when reading price and volume action. The doji shows that some indecision has entered the minds of sellers. Typically, traders don’t act on the pattern unless the price follows through to the upside within the next couple of candles.

Strategy 1: Bullish Harami and Volatility Filter

One should rely on the chart patterns, candle patterns, support and resistance, and so on. As the harami candle itself a price action component one should always include the price action strategy option in our analysis. The first candlestick is referred to as the “mother” with a large real body that embodies the smaller second candlestick, and thus creating the visual of a pregnant mother. Recently, we discussed the general history of candlesticks and their patterns in a prior post. We also have a great tutorial on the most reliable bullish patterns. When you spot a Harami candlestick pattern, the key here is to use the moving average to set an entry point.

AUD/USD holds steady ahead of Powell’s speech, as technicals suggest further downside – FXStreet

AUD/USD holds steady ahead of Powell’s speech, as technicals suggest further downside.

Posted: Mon, 21 Aug 2023 07:00:00 GMT [source]

Typically, you shouldn’t trade a pattern without having some sort of confirmation. The win rate will usually suffer, as well as the overall performance. You need to add some sort of filter or additional condition to ensure that you have a real edge. It’s also important to ensure that you take trades on a market and timeframe where the pattern works. No candlestick pattern works on all timeframes and markets, even if some want to make you believe that’s the case.

Now, you might also want to look at volume of the individual candles that make up the bullish harami pattern. For example, if the volume of the bearish candle is very high, it might indicate a final blowoff, as we talked about before. Candlesticks are by far the most used chart type in the trading world. Among them, the https://g-markets.net/ is a relatively popular pattern that traders use to identify chart reversals.

Here, the bullish trade will be initiated if the price moves above the shadow. The default “Intraday” page shows patterns detected using delayed intraday data. It includes a column that indicates whether the same candle pattern is detected using weekly data.

Below are some of the advantages and limitations of this pattern. The bullish harami belongs to the category of most popular candlestick patterns and is relied upon by many traders in their analysis of the markets. For expert traders, this harami candlestick would be a strong signal to sell the asset through the initiation of short positions. The first candle is usually long, and the second candle has a small body. The second candle is generally opposite in colour to the first candle.

- Investors seeing this bullish harami may be encouraged by this diagram, as it can signal a reversal in the market.

- Generally, the Harami pattern candlestick shows a changing trend.[1] Like other Japanese patterns can be bullish or bearish.

- The Harami Candlestick Pattern is considered a trend reversal pattern that can either be bullish or bearish, depending on the direction of the price action.

- For example, in some markets one day of the week or one-third of the month might be extra bullish or bearish.

- Since these patterns occur in relatively high frequencies, traders can implement Harami trading strategies as part of a consistent repeatable strategy to capture profits.

The harami cross pattern suggests that the previous trend may be about to reverse. The bullish pattern signals a possible price reversal to the upside, while the bearish pattern signals a possible price reversal to the downside. Traders typically combine other technical indicators with a bearish harami to increase the effectiveness of its use as a trading signal.

Harami (candlestick pattern)

For the rest of the trading session, buyers and sellers are equally strong and don’t manage to move the market any significant distance. The market closes around where it opened, and neither buyers nor sellers managed to win the fight. It’s extremely hard or impossible to know exactly what a market has been up to.